⛽ Part 4: The 2025 Oil Market Battle – Who Will Win, the U.S. or OPEC?

1️⃣ OPEC vs. the U.S. – The Battle for Oil Market Dominance ⚔️

The global oil market is set for a major showdown in 2025, as the U.S. and OPEC compete for control over production, pricing, and market share. While OPEC aims to stabilize prices through production cuts, the U.S. is expected to expand oil production, particularly in shale, to assert dominance in global energy markets.

📌 Strategic Interests of OPEC and U.S. Shale Producers ⚖️

✅ OPEC's Goal – Control supply to keep prices high 🛢️

✅ U.S. Goal – Expand production to gain global market share 🇺🇸

✅ The Challenge – OPEC’s ability to cut production vs. U.S. shale’s rapid growth 🔄

📌 Trump's Oil Expansion vs. OPEC's Production Cuts 🔥

✅ Trump’s likely policies:

Boost shale oil production 📈

Ease environmental regulations 🌎

Increase oil exports 🚢

👉 Trump's policy of increasing production: https://www.reuters.com/business/energy/us-crude-futures-down-1-barrel-trump-plan-boost-fossil-fuel-output-2025-01-20/

👉 U.S. Withdrawal from the Climate Agreement: https://www.whitecase.com/insight-alert/us-withdrawal-paris-agreement-impact-and-next-steps

Reduce production quotas 🛑

Maintain unity among member nations 🤝

Use supply cuts to push prices higher 💰

👉 Additional sensitivity of OPEC : https://www.opec.org/opec_web/en/press_room/7477.htm

👉 The 2025 oil market will be a battleground between OPEC’s price control tactics and the U.S.'s aggressive production expansion.

2️⃣ 2025 Oil Price Forecast – Factors Driving Volatility 📊

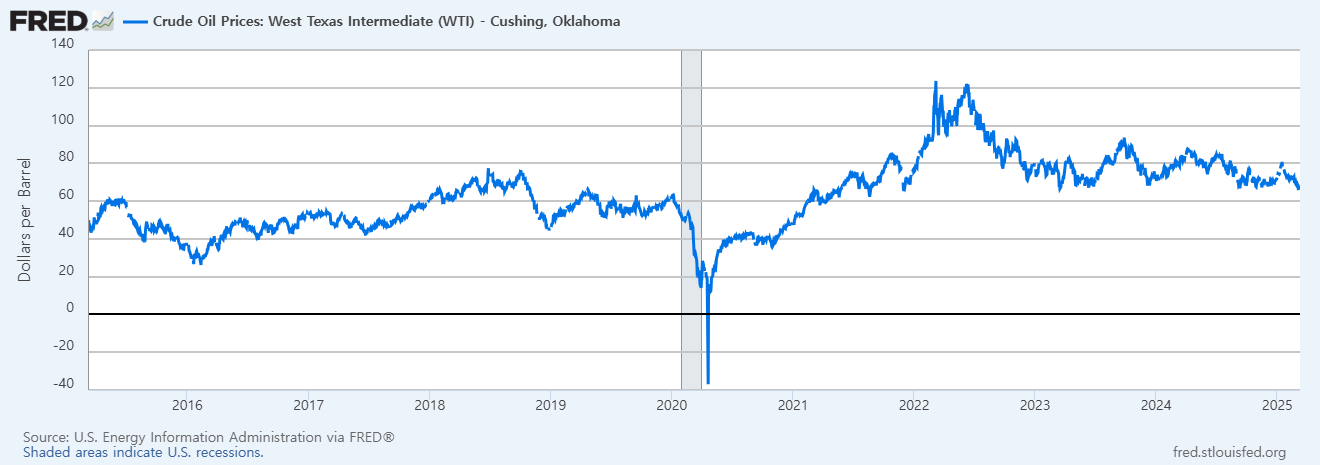

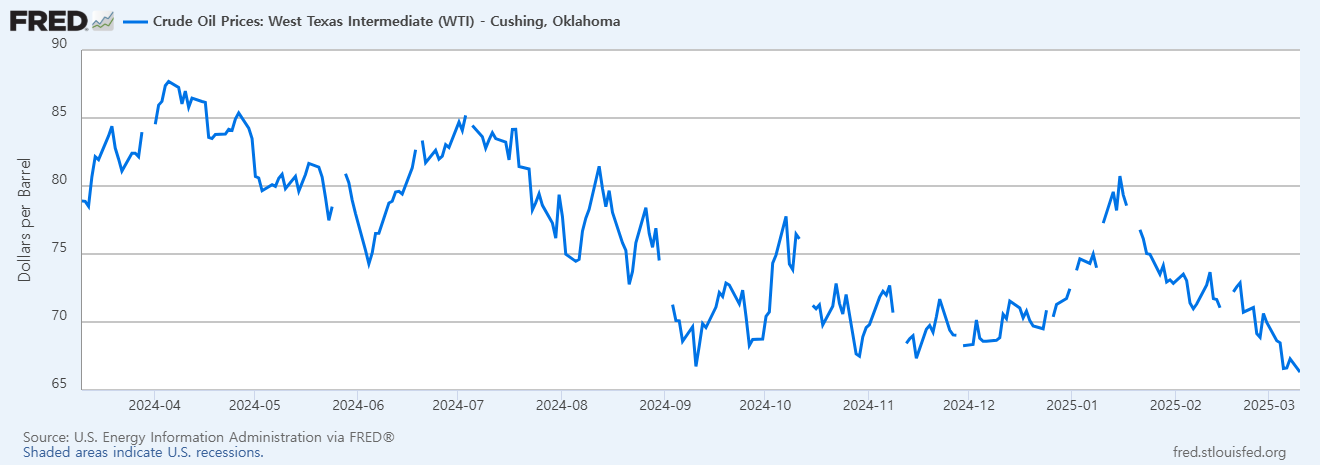

Crude oil prices are expected to face extreme volatility in 2025 due to economic uncertainty, geopolitical tensions, and supply chain disruptions.

📌 Global Economic Slowdown and Oil Demand Changes 📉

✅ Possible recession in the U.S. & Europe – Lower oil demand 📉

✅ Continued economic growth in China & India – Sustained demand 📈

✅ Expanding EV adoption – Gradual decline in gasoline consumption 🚗⚡

|

| oil price 10year |

|

| oil price 1year |

📌 Geopolitical Conflicts Impacting Oil Prices 🛡️

✅ Middle East Instability – Tensions in Iran, Saudi Arabia, and the UAE could disrupt supply 📌

✅ Russia-Ukraine War – Sanctions on Russian oil could continue to reshape global supply chains 🌍

✅ U.S. Sanctions on Energy Exports – Potential restrictions on Russian and Venezuelan oil 🚨

👉 The interplay between economic trends and geopolitical risks will determine whether oil prices remain stable or experience drastic swings in 2025.

3️⃣ U.S. Shale vs. OPEC Oil – The Market Share War 🚀

The battle for global oil market share will intensify as U.S. shale producers ramp up exports while OPEC nations strategize production cuts.

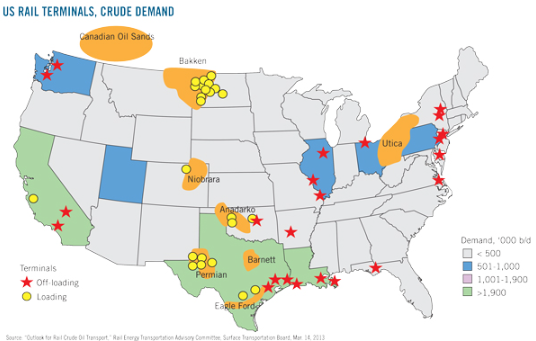

📌 U.S. Strategy – Expanding Oil Exports 🇺🇸

✅ Increase in shale production – Daily output projected to exceed 13 million barrels ⚡

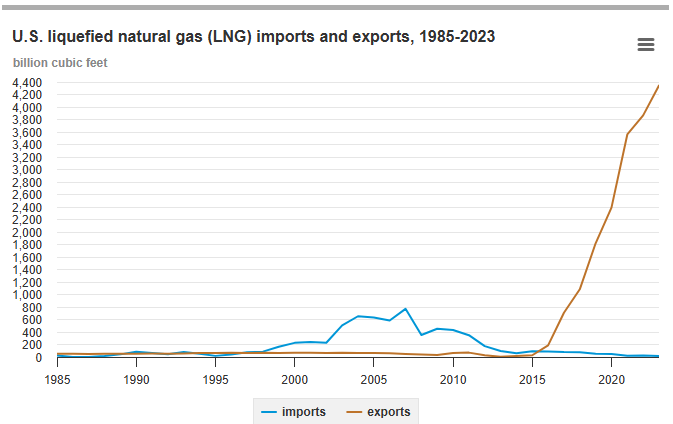

✅ Growing LNG exports – Strengthening energy ties with Europe & Asia 🌍

✅ Strengthening alliances – Closer ties with Canada, Mexico, and India 🤝

https://www.eia.gov/energyexplained/natural-gas/liquefied-natural-gas.php

📌 OPEC’s Strategy – The Production Cut Playbook 🛢️

✅ OPEC+ to cut supply further? – Possible deeper reductions to maintain price stability 📉

✅ Countering U.S. shale's growth – Strategic cuts to balance supply & demand ⚖️

✅ Ensuring profitability – Keeping oil prices high enough to sustain OPEC economies 💰

👉 The U.S. and OPEC are locked in a high-stakes market share battle that will shape global oil dynamics in 2025.

4️⃣ The Impact of the Oil Battle on Global Economy & Industries 🌍

The U.S.-OPEC oil war will send shockwaves across industries and emerging markets, affecting everything from EV adoption to global inflation.

📌 Oil Price Fluctuations and Their Impact on EVs, Batteries & Transportation 🚗🔋

✅ High oil prices → Accelerated EV adoption – Consumers switch to electric vehicles ⚡

✅ Low oil prices → Continued dominance of gasoline vehicles – Slower EV market growth ⛽

✅ Impact on battery prices – Fluctuating lithium & nickel costs 📉

📌 Energy Market Volatility & Emerging Markets 📊

✅ Oil-exporting nations gain or suffer – Middle East & Russia highly affected 🛢️

✅ Emerging economies at risk – High oil prices could strain energy-dependent developing nations ⚠️

✅ Shift in global trade alliances – Countries will reassess oil import/export partners 🌎

👉 The 2025 oil market battle will reshape industries and economies, with ripple effects across global trade and energy security.

✍️ Conclusion: Who Will Win the 2025 Oil Market War? ⚖️

The battle between the U.S. and OPEC will define global energy markets in 2025. The U.S. aims to flood markets with shale oil, while OPEC seeks to stabilize prices through supply cuts.

The outcome will depend on economic trends, geopolitical stability, and technological advancements in renewables. A prolonged market war could increase price volatility, disrupt energy-dependent economies, and accelerate the shift towards alternative energy sources. 🌎🔥

.webp)

댓글

댓글 쓰기