⛽Part 3: Trump’s Second Term & Global Energy Supply Chain Restructuring – America’s New Strategy

1️⃣ The Need for Global Energy Supply Chain Changes – Why Now? ⚡

📌 Pandemic, War, and Trade Wars – The Energy Supply Chain Crisis 🌍

✅ Pandemic Disruptions – Global logistics and energy production suffered massive delays. 😷

✅ Russia-Ukraine War – Western sanctions on Russia destabilized European energy security. ⚠️

✅ U.S.-China Trade War – Washington is aiming to reduce reliance on Chinese raw materials and energy infrastructure. 🔄

>> Minerals for Weapons? The Congo’s High-Stakes Choice in the Era of Military Aid 💎

https://drmacrocapital.blogspot.com/2025/03/minerals-for-weapons-congos-high-stakes.html

📌 U.S. Energy Supply Chain Reshuffle Goals for 2025 🎯

✅ Reducing Dependence on China & Russia – Strengthening domestic energy production and diversifying imports.

✅ Enhancing Energy Security – Increasing investment in local energy production and storage.

✅ Investing in Renewable & Future Energy Technologies – Expanding electric vehicle (EV) and battery manufacturing. 🚀

👉 The Biden-Trump policy contrast will likely be stark, with Trump's second term focusing on fossil fuel expansion, deregulation, and energy exports. 🔥

2️⃣ U.S. Friendshoring & Reshoring Strategy in the Energy Sector 🇺🇸

Friendshoring (favoring supply chains in allied nations) and reshoring (bringing energy production back to the U.S.) will be key policies to curb reliance on China and Russia while strengthening trade ties with friendly nations.

📌 U.S. Strategy to Reduce Dependence on China & Russia ⚖️

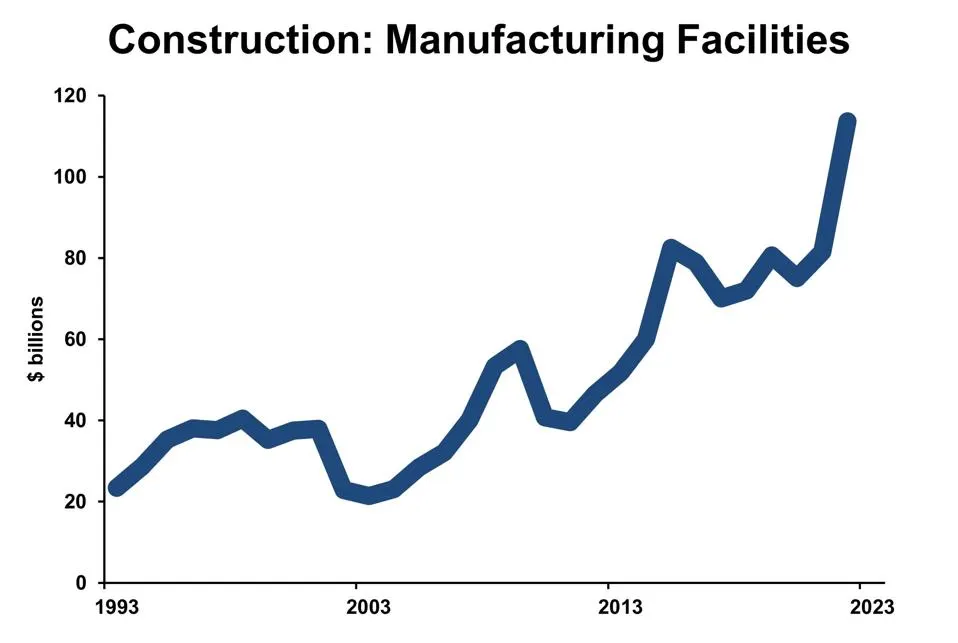

✅ Reshoring Key Industries – Increasing domestic production of batteries, semiconductors, and energy equipment.

✅ Friendshoring with Allies – Diversifying energy partnerships with trusted trade partners.

✅ Supply Chain Diversification – Sourcing critical energy materials from multiple countries. 🌍

📌 Strengthening Energy Cooperation with Pro-U.S. Nations 🤝

✅ Mexico 🇲🇽 – Enhancing North American energy integration, particularly in natural gas and oil.

✅ India 🇮🇳 – Positioning India as an alternative manufacturing hub for renewables.

✅ Saudi Arabia 🇸🇦 – Restoring U.S.-Saudi relations to stabilize oil supply chains.

👉 A second Trump presidency will likely escalate the push toward energy independence and forge stronger ties with energy-rich allies. 🔄

energy.ec.europa.eu

3️⃣ Semiconductors, Batteries, and Rare Earths – The Key Energy Supply Chain Links 🔋

The energy sector and technology supply chains are deeply interconnected. The future of EVs, batteries, and semiconductors depends on securing raw materials and expanding production capabilities.

📌 The Battle for EV & Battery Raw Materials 🔋🚗

✅ Lithium, Nickel, and Cobalt Wars – The U.S. is competing with China for control over these key battery components.

✅ Curbing Chinese Battery Market Dominance – New restrictions on Chinese battery imports could be implemented.

✅ Expanding Domestic Battery Manufacturing – Tesla, GM, and Ford are investing in battery plants in the U.S.

https://theicct.org/publication/us-ldv-battery-manufacturing-jobs-by-2032-jan24/

theicct.org

📌 Semiconductors & Energy – The U.S.-China Tech War 🖥️⚡

✅ Chip Production Requires Massive Energy Supplies – Semiconductor fabs consume vast amounts of electricity.

✅ U.S. Sanctions on Chinese Chipmakers – Further restrictions on China’s semiconductor industry are possible.

✅ Boosting Domestic Semiconductor Production – The U.S. is ramping up chip fabrication and energy infrastructure.

www.cpreview.org

👉 The U.S. aims to secure leadership in battery and semiconductor manufacturing while reducing reliance on China-controlled rare earth elements. ⚡

4️⃣ The Global Economic Impact of U.S. Energy Supply Chain Reshuffling 🌎

America's energy supply chain restructuring will have far-reaching implications for businesses, global trade, and geopolitical alliances.

📌 The Shift of Global Production Hubs (Tesla, Apple, etc.) 🚚

✅ Tesla 🚗 – Expanding U.S. battery plants & cutting dependence on China.

✅ Apple 🍏 – Reducing reliance on China-based production; shifting to India & Vietnam.

✅ TSMC 🏭 – Investing in U.S. semiconductor manufacturing for supply chain security.

📌 The Formation of New Economic Blocs Between the U.S., China, and Europe ⚖️

✅ U.S.-Europe-Japan-India Bloc – Strengthening supply chain resilience among democratic nations.

✅ China-Russia-Middle East Bloc – Expanding alternative energy and trade routes.

✅ Europe’s Dilemma – Balancing between the U.S. and China while reducing Russian energy dependence.

👉 The U.S. energy strategy shift will reshape global supply chains and create new economic blocs in the coming years. ⚠️

✍️ Conclusion: How Will the U.S. Energy Strategy Impact Global Markets? 📊

The U.S. under Trump’s second term is expected to prioritize energy independence, expand fossil fuel production, and restructure energy supply chains to counter China and Russia. Friendshoring and reshoring will boost domestic manufacturing and create stronger energy partnerships with allied nations.

However, this aggressive shift may trigger economic tensions with China, disrupt global trade flows, and force businesses to adapt to a new geopolitical landscape. The global economy is set for a major realignment, with energy supply chains at the core of this transformation. 🌎⚖️

.png)

댓글

댓글 쓰기