⛽ Part 2: U.S. vs. China vs. Russia – The 2025 Energy Power Struggle Intensifies

As the global energy war heats up in 2025, the three superpowers—the United States, China, and Russia—are competing for energy dominance. From fossil fuels to renewables, each country is strategizing to secure resources, influence markets, and control energy-dependent regions. But how will this energy battle reshape the global economy and geopolitics? Let’s explore. 🔥⚡

🌎 1. The Global Energy Power Struggle – Why Are the U.S., China, and Russia Competing?

Energy is more than just fuel—it’s a strategic weapon that influences economic strength, political alliances, and military power. The U.S., China, and Russia each have different energy priorities, but they all share one goal: global energy dominance.

⚔️ Why Is Energy So Critical in 2025?

✔️ Energy security determines economic power—countries that control energy have leverage over global markets. 📈

✔️ Geopolitical conflicts (Ukraine, South China Sea, Middle East) revolve around energy resources. 🏴

✔️ Energy prices influence inflation, trade, and financial stability worldwide. 💰

🔍 U.S. vs. China vs. Russia – Key Energy Resources & Strategies

✔️ United States 🇺🇸 – Expanding LNG (Liquefied Natural Gas) and oil exports, reducing reliance on foreign sources.

✔️ Russia 🇷🇺 – Using natural gas exports as political leverage, particularly in Europe and Asia.

✔️ China 🇨🇳 – Investing in renewables while securing fossil fuel imports, aiming for energy independence.

This three-way competition is shaping energy markets, global alliances, and military strategies.

⛽ 2. U.S. vs. Russia – The Battle for the European Energy Market

One of the biggest battlegrounds in the energy war is Europe, where the U.S. and Russia are competing for dominance in natural gas supply.

🏭 The U.S. LNG Export Expansion Strategy

✔️ The U.S. is aggressively expanding LNG exports to replace Russian gas in Europe. 🚢

✔️ LNG terminals in Germany, Poland, and the Netherlands are reducing Europe’s reliance on Russian gas.

✔️ Trump’s administration is offering long-term LNG deals to strengthen U.S.-Europe energy ties.

https://www.eia.gov/energyexplained/natural-gas/liquefied-natural-gas.php

🛢️ Russia’s Natural Gas Power & the Nord Stream 2 Impact

✔️ Russia remains Europe’s largest natural gas supplier, despite sanctions.

✔️ The Nord Stream 2 pipeline was blocked but is still a major geopolitical factor in EU-Russia relations.

✔️ Russia is shifting gas exports toward China, reducing dependence on European buyers.

https://www.civilsdaily.com/news/nord-stream-pipeline-to-stay-shut/

The battle for Europe’s energy supply is reshaping diplomatic alliances and economic policies across the continent.

☀️ 3. U.S. vs. China – The Renewable Energy vs. Fossil Fuel War

While the U.S. is doubling down on oil, gas, and coal, China is betting big on renewables while maintaining fossil fuel imports for energy security.

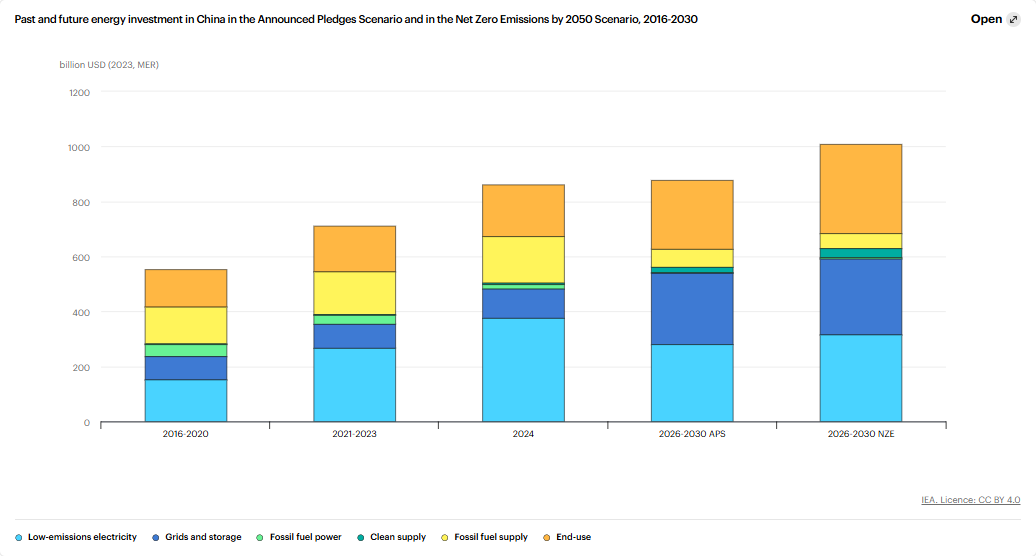

🌞 China’s Energy Strategy – Balancing Renewables & Fossil Fuels

✔️ China is the world’s largest investor in solar and wind power. 🌍

✔️ Despite green energy investments, China is still the top global coal consumer. 🏭

✔️ Beijing is securing long-term oil & gas deals with Russia and the Middle East.

https://www.evwind.es/2024/10/07/top-6-countries-using-wind-energy/101572

www.evwind.es

⚡ Could the U.S. Sanction China’s Energy Sector?

✔️ Trump’s administration may target China’s energy imports with new sanctions.

✔️ U.S. trade policies could restrict China’s access to advanced clean energy technology.

✔️ A U.S.-China energy decoupling could reshape global supply chains.

As both nations push their competing energy visions, climate policies and economic strategies will shift dramatically.

🌍 4. How the U.S.-China-Russia Energy War Will Impact the Global Economy & Security

This intense energy competition is already disrupting markets, trade, and international stability.

📊 Energy Prices & Global Financial Markets

✔️ Fluctuations in oil & gas prices are driving inflation and economic uncertainty. 📉

✔️ Energy shortages and supply chain disruptions could trigger global recessions.

✔️ Nations dependent on imported energy (Japan, EU, India) are adapting policies to the shifting market.

https://fred.stlouisfed.org/series/PNGASJPUSDM#

fred.stlouisfed.org

⚔️ Geopolitical Tensions – South China Sea, Ukraine & Beyond

✔️ South China Sea disputes over energy resources are increasing U.S.-China naval conflicts. 🚢

✔️ Russia’s war in Ukraine remains a major factor in global energy supply chain instability.

✔️ The U.S. and NATO are strengthening energy security measures to counter Russian influence.

This energy power struggle is reshaping the 21st-century global order, with long-term consequences for trade, diplomacy, and military conflicts.

>>U.S. Intervention in Ukraine's Ceasefire Agreement… But Why Is Saudi Arabia the Mediator? 🤔

🔮 Conclusion: The Future of the U.S.-China-Russia Energy Battle

The global energy war is far from over. With the U.S. pushing for fossil fuel dominance, China accelerating renewable energy expansion, and Russia leveraging natural gas exports, the world’s energy future remains uncertain.

💡 Will the U.S. succeed in controlling the European energy market?

💡 Can China break free from fossil fuel dependency?

💡 Will Russia adapt to shifting alliances, or become more isolated?

www.aljazeera.com

The coming years will define the next phase of the global energy war. What do you think? Let’s discuss! ⬇️💬

.jpg)

.png)

.png)

.png)

댓글

댓글 쓰기